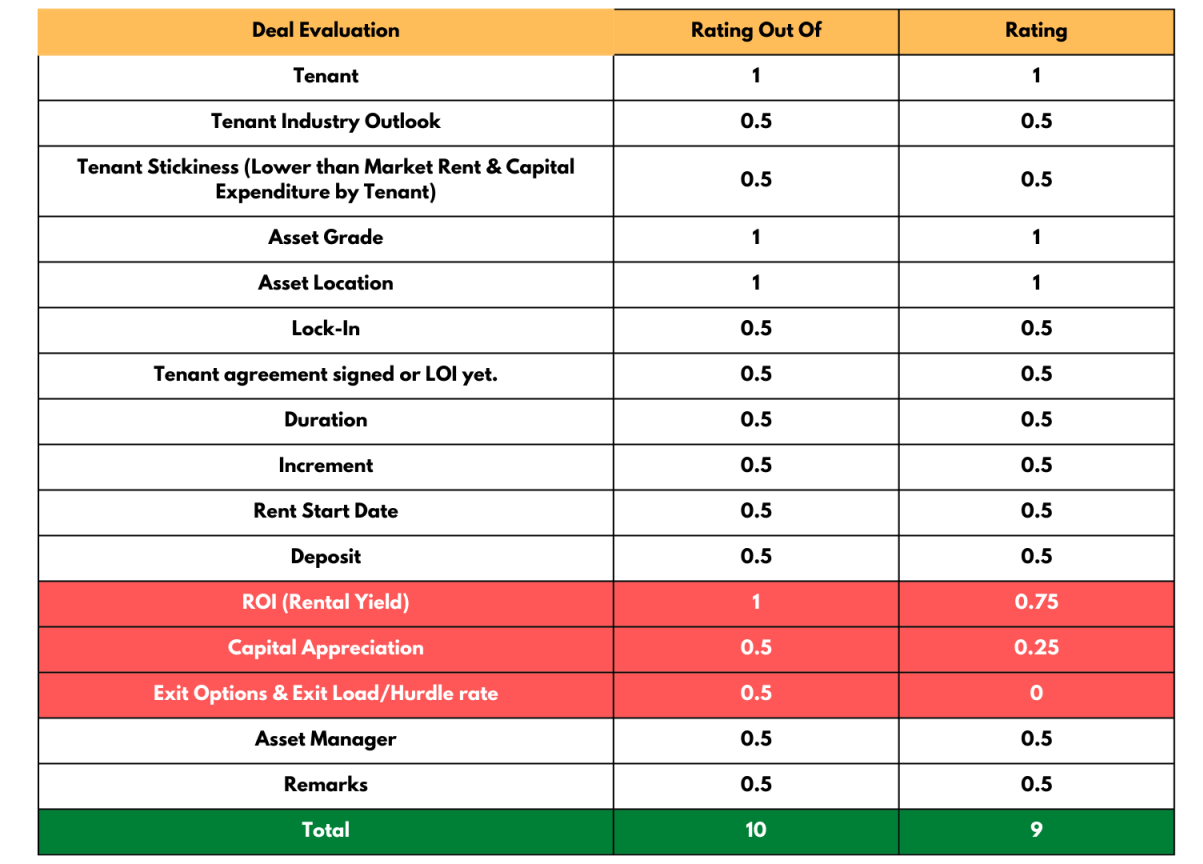

The Review – 9/10 – Excellent Opportunity

We grade opportunities across 10 criteria (sometimes with sub-criterion) to arrive at an objective review. A quick points summary is followed by a detailed analysis. Format: Criteria – (Score out of/max score possible). Example: Tenant – (1/1)

Less than optimum points are highlighted like this.

Quick Summary

- Tenant (1/1)

- Tenant Industry Outlook (0.5/0.5) + Tenant Stickiness (0.5/0.5) = (1/1)

- Asset Grade (1/1)

- Asset Location (1/1)

- Lock-In (0.5/0.5) + Lease agreement registered (0.5/0.5) = (1/1)

- Agreement Duration (0.5/0.5) + Increment (0.5/0.5)=(1/1)

- Rent start date (0.5/0.5)+ Deposit (0.5/0.5)=(1/1)

- Return On Investment ROI (.75/1)

- Capital appreciation (0.25/0.5) + Exit Options (0/0.5) =(0.25/1)

- Asset Manager Credibility (0.5/0.5) Our 2 cents (0.5+0.5) =(1/1)

Total = 9/10

Detailed Review With Analysis

Tenants – Leading International Sportswear Brand.

With revenues of over 5.67 lac crores in 2021, this brand is one of the leading sportswear brands in the world. They routinely sponsor the world’s largest sports events whether it’s football, Cricket, F1 or athletics. They are present in over 120 countries. An MNC of this nature means AAA+ tenant for us.

Tenant Industry Outlook + Tenant Stickiness

- Industries that remain robust during up and down market cycles are recommended. If the tenant is paying lower than or equal to market rentals and spends money (CAPEX) to build furniture & fixture, it’s an ideal scenario as the real cost of shifting is high and therefore the tenant sticks to the property.

- COVID has made people acutely aware of the importance of health and hence people are investing more time in sports and leisure activities. This means the sportswear category stands to gain. With school and clubs opening up 100% there will be a renewed demand for such wear. As in all other industries, the top players in the category like our tenant typically gain more because of their brand.

- The tenant will be paying 52.5 rupees as rentals whereas the neighbourhood average is 60 to 75 rupees/ square feet.

- The tenant will be spending significant CAPEX in doing up the property and this increases their stickiness.

Asset Grade – Should Be An A-Grade Asset.

- The brand new state-of-the-art development, this property is an A-grade asset. Here are some pictures of the asset.

- The brand new state-of-the-art development, this property is an A-grade asset. Here are some pictures of the asset.

Asset Location – Should Be A Business District/SEZ/Industrial Hub With Excellent Travel Infrastructure.

- Mahadevpura off the outer ring road is one of the most sought-after locations in Bengaluru. The Mahadevpura metro terminal is just 300 meters from the asset and is just 3 km away from the KK Puram railway station. The Kempegowda International Airport is only 40kms away.

- EY, Airbus, Microsoft, HP, Samsung, and Google are just a few of the many blue-chip corporations in the vicinity.

Lock-In 3+ Years Recommended And Registered Lease Agreement Recommended.

- The lock-in is 4.3 years which is more than our optimal 3 years. The lease agreement has been registered.

- The lock-in is 4.3 years which is more than our optimal 3 years. The lease agreement has been registered.

Duration – 5+ Recommended. An Increment Of 5% A Year Or 15% Every 3 Years Is Recommended.

- A five-year agreement is ideal and we have a 15-year agreement – which is excellent.

- Either 5% every year or 15% every 3 years is the industry standard and we will be getting 15% every 3 years.

Immediate Rental + 6 Month Deposit Recommended.

- Rentals start immediately – April 2022 and hence we suggest you sign up and pay up the entire 30 lacs soon 🙂

- A 6-month deposit is ideal, we have that.

- The average rental yield is lower by .20% @ 7.8%. While office assets give a 7-8% return. Given the competition in the market, we believe 8% is ideal.

Capital Appreciation For Offices Should Be 5%. Quick Exit Is Ideal And The Hurdle Rate Should Be Above 12%.

- While STRATA is expecting a robust appreciation @ 7% p.a, we recommend that we expect not more than 3% appreciation as that appreciation is variable to market risks.

- Like in the case of a fully owned property, exiting (selling) takes 3-4 months, we should also consider a 3-4 months exit cycle for fractional ownership. We recommend investing with a time horizon of 5-7 years for this asset. Here are 3 chief exit options.

- Total asset sale – at an appropriate time (after a few years) the asset manager will sell the asset to a new investor (typically a fund house) after getting approval from 2/3rd investors.

- Annual sale – Asset managers offer an annual sale window wherein you can exit your investment at a discount to new investors.

- Private sale – You can sell your investments privately to a buyer you have found.

Credible Asset Manager + Our Recommendation

- STRATA is a leading asset manager with over 500Cr of assets under management. Strata is backed by the likes of Elevation Capital (Swiggy, ClearTax & more) Kotak, Mayfield and Gruhas Investments (A fund by Zerodha’s Nikhil Kamath)

- The KT Office fractional ownership opportunity has all the right ingredients as you can see in the chart below and therefore we highly recommend investing in this opportunity.